Understanding Error Codes FintechAsia: A Comprehensive Guide to Common Issues

Introduction to Error Codes in FintechAsia

Error Codes FintechAsia are essential tools that play a vital role in identifying and troubleshooting issues during financial transactions. These codes provide users and support teams with detailed insights into the problem at hand, making it easier to quickly resolve issues. This guide will explore the significance of these codes, common errors encountered on the platform, and best practices for addressing them.

Why Error Codes Matter in Fintech

In the fast-paced world of fintech, Error Codes FintechAsia serve as essential diagnostic tools. When something goes wrong during a transaction, error codes offer a quick way to pinpoint the problem, allowing for faster resolution. Without these codes, identifying and fixing issues in complex systems would be much harder, leading to delays and a frustrating user experience. By helping support teams address problems promptly, error codes ensure smoother financial operations and enhance trust in the platform.

An Introduction to FintechAsia and Its Influence on the Market

Error Codes FintechAsia a leading platform in the financial technology space, known for its cutting-edge services and innovative approach to financial transactions. As a key player in the industry, FintechAsia’s reliable and efficient service is critical to its reputation. Error codes within the platform help ensure operations remain smooth by identifying and resolving issues promptly, ultimately supporting FintechAsia’s continued growth and leadership.

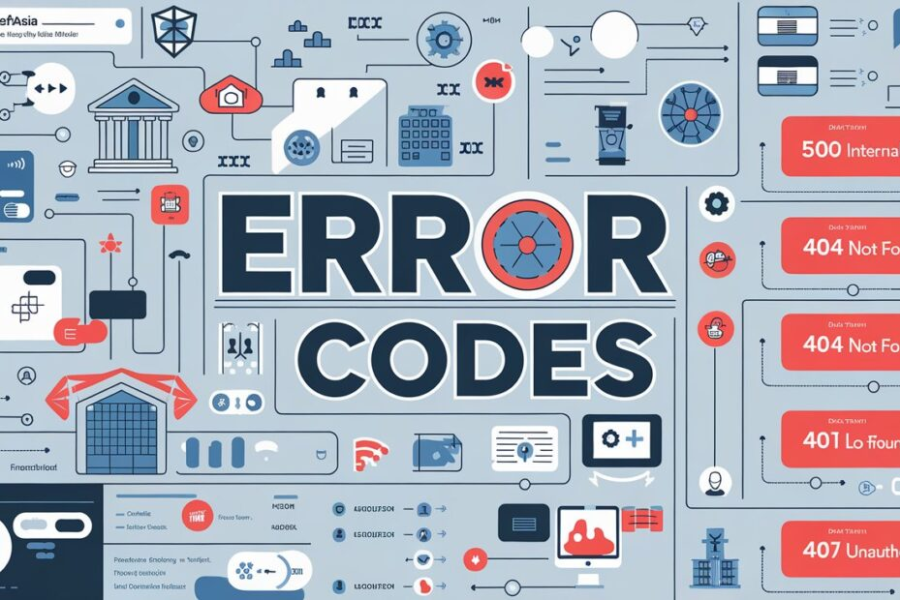

Common Error Codes FintechAsia and What They Mean

Common Errors and How They Occur

FintechAsia users may encounter several common error codes while making transactions. Each error is designed to quickly signal a particular issue, making it easier to troubleshoot and resolve. By understanding these codes, users can mitigate disruptions and keep their transactions running smoothly.

Detailed Breakdown of Common Error Codes

- Error Code 100: Authentication Failure

This code occurs when login credentials are incorrect. Users should double-check their username and password and try again. - Error Code 200: Insufficient Funds

This error arises when a user’s account balance is too low to complete a transaction. Users must top up their account before proceeding. - Error Code 300: Transaction Timeout

When a transaction takes too long to process, the system automatically cancels it, triggering this error. Users can try again later. - Error Code 400: Invalid Account Information

Incorrect account details, such as wrong account numbers or invalid bank codes, trigger this code. Users should review their information to correct the error. - Error Code 500: Server Communication Failure

This error typically reflects temporary server issues. Users are advised to wait for the problem to resolve before retrying the transaction.

Causes Behind Error Codes FintechAsia

Typical Causes of Errors

Each error code in FintechAsia Error Codes FintechAsia corresponds to specific problems. For instance, an incorrect password results in an authentication failure (Error 100), while an insufficient balance triggers Error 200. Recognizing these patterns helps both users and support teams diagnose and resolve issues faster.

System-Related Errors

Errors in FintechAsia can also be caused by systemic issues such as server downtimes, network outages, or software bugs. These technical problems can generate multiple errors across the platform, disrupting service for Error Codes FintechAsia many users at once.

User-Generated Errors

Sometimes, user actions directly lead to error codes. For instance, incorrectly entered account details can result in Error Code 400, while Error Codes FintechAsia attempting unauthorized transactions can prompt an authentication failure. Understanding these causes can help prevent future errors.

The Impact of Error Codes FintechAsia

How Errors Affect Transactions

Error codes can disrupt transactions, causing Error Codes FintechAsia delays and inconveniencing users. Frequent errors may damage user confidence in the platform, leading to frustration and a decline in overall user satisfaction.

Financial and Operational Consequences

Error codes also have financial and operational consequences for FintechAsia. Failed transactions can lead to lost revenue, and fixing recurring issues increases support team workloads, driving up operational costs.

Real-World Examples: Error Code Incidents in FintechAsia

FintechAsia has faced notable Error Codes FintechAsia challenges related to error codes, including a significant server outage that led to widespread Error Code 500 issues. This resulted in delayed transactions and user dissatisfaction. In another case, users experienced extended delays due to transaction timeouts (Error Code 300), highlighting the importance of swift resolution to maintain user trust.

Solutions and Best Practices for Error Management

Resolving Common Error Codes

The key to resolving error codes lies in identifying the root cause and applying the appropriate fix. For example, users encountering Error Codes FintechAsia should check their login details, while those facing Error 200 need to ensure their account has sufficient funds.

Preventing Future Errors

Proactive measures such as regular system updates, thorough testing, and continuous monitoring can help prevent many Error Codes FintechAsia from occurring. Ensuring that users understand platform guidelines can also reduce the likelihood of user-related issues.

Best Practices for Developers

Fintech companies can minimize Error Codes FintechAsiaby implementing strong security protocols, designing systems that efficiently handle high transaction volumes, and offering users clear, actionable error messages. These steps create a more reliable platform and a better user experience.

Future Technologies and Trends in Error Code Reduction

Innovations in Error Detection

Emerging technologies like real-time monitoring systems are becoming increasingly important for catching issues before they escalate. These Error Codes FintechAsia tools enable faster identification and resolution of errors, reducing the number of disruptions that users experience.

AI’s Role in Preventing Errors

Artificial intelligence (AI) and machine learning (ML) are playing a key role in predicting and addressing potential errors. These technologies can analyze transaction data to forecast where problems might arise and suggest preemptive solutions.

Blockchain and Beyond

Looking ahead, technologies such as blockchain may offer solutions for more secure, error-resistant transactions. As fintech Error Codes FintechAsia continues to evolve, these advancements will reduce error rates and improve the reliability of platforms like FintechAsia.

Regulatory Considerations for Error Management

Regulatory Oversight

Fintech platforms like FintechAsia must adhere to regulations that govern how errors are reported and resolved. These rules ensure that platforms handle errors responsibly, protecting users and maintaining transparency.

Compliance in Error Management

To comply with industry regulations, FintechAsia must maintain thorough records of errors and resolutions, ensuring that they follow best practices for secure and transparent financial transactions.

The Role of Regulators

Regulators play an essential role in ensuring fintech companies maintain transparency around error codes. This oversight Error Codes FintechAsia helps build trust between users and platforms by guaranteeing that errors are communicated clearly and resolved promptly.

Empowering Users: Education and Support

Educating Users on Error Codes

When users understand Error Codes FintechAsia error codes and how to resolve them, they’re more likely to navigate issues independently. Providing clear, accessible information about common errors can empower users to take action, reducing frustration and improving their experience.

Effective Customer Support

FintechAsia can enhance customer support by training teams to respond quickly and effectively to error code inquiries. Step-by-step solutions and clear communication will help resolve issues faster and ensure a more positive user experience.

Helpful Resources for Users

Providing users with tools such as Error Codes FintechAsia, troubleshooting guides, and self-service resources can reduce the need for customer support. By offering these resources, FintechAsia can empower users to resolve issues on their own, boosting overall satisfaction.

FAQs:

1. What are error codes in FintechAsia?

Error Codes FintechAsia are Error Codes FintechAsia unique identifiers that signal issues or problems within the platform, especially during financial transactions. These codes help users and support teams quickly understand what went wrong so they can address the issue effectively.

2. Why am I seeing Error Code 100 (Authentication Failure)?

Error Code 100 occurs when the system cannot verify your login credentials. This usually happens due to an incorrect username or password. Double-check your details and, if needed, reset your password.

3. What does Error Code 200 (Insufficient Funds) mean?

Error Code 200 means there are not enough funds in your account to complete the transaction. You need to add more money to your account to proceed.

4. How can I fix Error Code 300 (Transaction Timeout)?

Error Code 300 happens when a transaction takes too long to process, causing the system to cancel it. Try initiating the transaction again later, as this could be due to temporary delays or high traffic on the platform.

5. What causes Error Code 400 (Invalid Account Details)?

Error Code 400 occurs when the account information entered is incorrect, such as an invalid account number or bank code. Double-check your details to ensure accuracy.

6. How do I resolve Error Code 500 (Server Communication Error)?

Error Code 500 indicates a communication issue between your device and FintechAsia’s servers, likely due to a temporary server problem. Wait for a while and then try again.

7. Are error codes caused by my mistakes or system issues?

Error codes can result from both user-related mistakes (like incorrect account details) and systemic issues (like server outages). Identifying the root cause helps in resolving the error quickly.

8. How do error codes impact my transactions?

Error codes can cause delays, prevent transactions from being processed, or lead to temporary disruptions in service. Understanding and addressing them quickly ensures smooth financial operations.

9. What can I do to avoid encountering error codes?

You can reduce the likelihood of encountering error codes by ensuring accurate account details, maintaining sufficient funds, and keeping your login credentials up to date. Regularly updating your app and monitoring your transactions can also help prevent errors.

10. Who should I contact if I can’t resolve an error code on my own?

If you’re unable to resolve an error code, contact FintechAsia’s customer support. They can guide you through troubleshooting and offer solutions specific to your issue.

Conclusion:

Error Codes FintechAsia serve as a vital tool in maintaining smooth financial operations on the platform. They provide both users and developers with clear indicators of issues, allowing for swift identification and resolution. By understanding the causes and solutions for these error codes, users can minimize disruptions and ensure seamless financial transactions. Moreover, FintechAsia’s commitment to transparency and innovation, including the use of advanced technologies like AI and real-time monitoring, ensures that error codes are not only detected promptly but also addressed effectively.